In Brief

Prediction markets are turning into one of crypto’s hottest narratives heading into 2026. What started as a niche DeFi experiment is now pulling billions in trading volume, catching institutional attention, and getting regulatory approval.

That growth could be huge for low-cap altcoins tied to prediction market infrastructure.

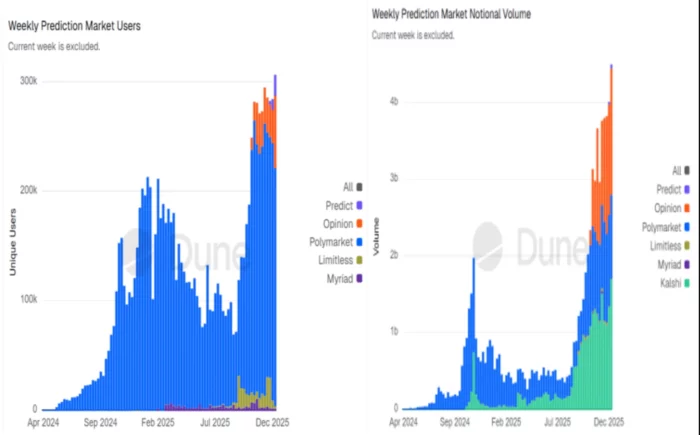

Prediction Markets Hit Record Volumes

By late December 2025, prediction markets recorded over $4.5 billion in weekly notional volume—a new record and roughly a 12.5% increase from the week before.

According to industry observer Martins, Kalshi alone accounted for more than $1.7 billion, representing nearly 38% of total weekly activity.

Prediction markets are here to stay.

Last week closed with over $4.5B in Total Weekly Notional Volume, setting a new record for weekly activity and surpassing the previous high by roughly $500M, an increase of approximately 12.5% WoW.

The week was led by @Kalshi, which… pic.twitter.com/4uvO8Frzhc

— Martins (@wogaam) December 29, 2025

This caps off a strong year. In November, prediction markets hit $9.5 billion in monthly volume, blowing past meme coins at $2.4 billion and NFTs at around $200 million. Traders are shifting toward platforms with actual utility instead of pure speculation.

From Hype to Real Utility

The surge reflects a broader change in crypto behavior. Instead of chasing meme coin pumps, traders are engaging with platforms that let them bet on real outcomes—politics, sports, macroeconomics, and crypto events.

Dune data shows nearly 279,000 weekly active users, over $4 billion in weekly volume, and 12.67 million transactions. That’s sustained engagement, not a one-week pump.

Institutions are getting involved too. Coinbase is reportedly preparing to launch prediction markets, Gemini’s affiliate secured regulatory approval to offer them in the US, and Trump Media & Technology Group signaled plans to enter the space.

As the sector scales, demand is growing not just for front-end platforms but also for backend infrastructure—especially oracles that resolve outcomes accurately. That’s where these low-cap altcoins come in.

UMA: Oracle Infrastructure Play

With a market cap around $63 million, UMA plays a foundational role in prediction markets. It secures Polymarket, one of the biggest decentralized prediction platforms.

UMA’s optimistic oracle design assumes data submissions are correct unless disputed. According to UMA, around 99% of assertions have gone undisputed since 2021, with dispute rates dropping as integrations improve.

The same dispute mechanism is now being used beyond prediction markets, including in IP protection systems like Story Protocol.

UMA trades around $0.71 right now. Price action has been quiet recently, but UMA’s upside comes from infrastructure demand, not retail hype. If prediction market volumes keep growing in 2026, UMA could benefit long-term.

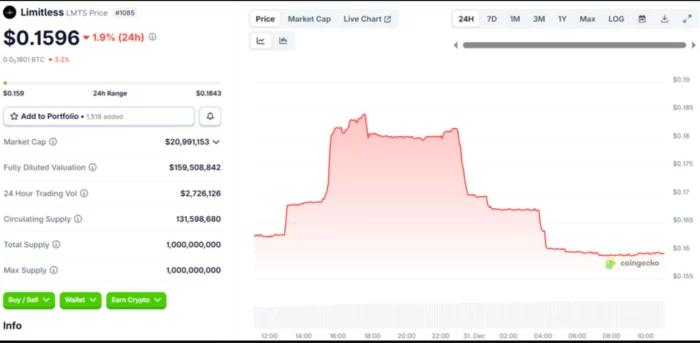

Limitless: Fast-Growing Platform

Limitless has a market cap of about $21 million. In December alone, the platform recorded over $760 million in notional trading volume—up massively from roughly $8 million in July.

Community commentary highlights steady growth in monthly active traders and expanding market coverage, including sports betting.

The LMTS token is down slightly today, but adoption metrics suggest real usage growth instead of hype-driven pumps. If prediction markets keep scaling in 2026, early movers like Limitless could see serious upside despite small valuations.

Predict.fun: New Entrant Gaining Traction

Predict.fun, built on BNB Chain, is the newest player but has moved fast. Despite launching recently, the platform has crossed $100 million in notional volume, hit over 30,000 daily transactions, and attracted more than 6,000 unique users at peak. Total value locked recently topped $11 million.

Backed by YZi Labs, Predict.fun is running weekly airdrops through its Predict Points system to incentivize liquidity and participation.

Early data shows the platform has already captured around 1% of total prediction market volume—impressive for a newcomer.

What to Watch in 2026

Prediction markets aren’t just experimental betting tools anymore. They’re turning into data-driven financial products with institutional backing.

As volumes grow and regulation stabilizes, low-cap altcoins tied to this sector could see outsized opportunities—along with elevated risk.

UMA, Limitless, and Predict.fun offer different ways to get exposure to this trend. If momentum holds, 2026 could be a defining year for prediction markets and the small-cap tokens building the infrastructure.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.