In Brief

Ethereum’s staking dynamics just hit a turning point. For the first time in three months, more ETH is waiting to enter staking than exit it—a shift that some analysts think could signal the end of recent selling pressure.

Entry Queue Overtakes Exit Queue

Ethereum’s validator queues track how much ETH is lined up to stake versus how much is waiting to unstake and potentially sell. According to ValidatorQueue data, the entry queue flipped above the exit queue on September 10 and has stayed there since.

Right now, about 745,600 ETH are waiting to enter staking, while only 360,500 ETH are in the exit queue. That’s a notable reversal from the past few months.

Analyst CryptoHuntz called the recent period a “Great Migration” that pushed ETH down from $4,800 in early September to around $3,000 now.

The Great Migration is over… finally, the selling pressure from the last three months is drying up. Demand to enter ETH staking is back in the driver’s seat. Nature is healing.

Historical Pattern Suggests Potential Upside

Abdul, Head of DeFi at Monad, pointed out that roughly 5% of ETH’s supply—about $15 billion worth—has changed hands since July. He expects the validator exit queue to hit zero by January 3.

More importantly, he noted that the last time the entry queue topped the exit queue was back in June. ETH’s price doubled in the weeks that followed.

If history repeats, ETH could see a similar bounce from current levels around $3,000.

Big Players Are Staking Too

Cryptowakeup analysis shows that BitMine, which holds the largest ETH treasury in the world at roughly $12 billion, recently moved 74,880 ETH (about $219 million) into staking contracts. That’s just a slice of their total 4.07 million ETH holdings.

If BitMine stakes everything at the current 3.12% APY, they’d earn around $371 million annually. That kind of institutional commitment adds another layer of support to the bullish case.

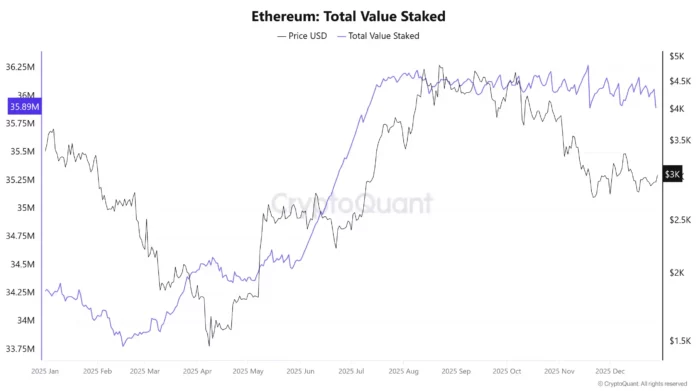

CryptoQuant shows total staked ETH has held steady at around 36 million since the price peaked near $4,900. While that’s encouraging, it’s not a clear breakout signal yet.

Still Too Early to Call the Bottom

Despite these positive signs, it’s premature to say ETH has bottomed out. On-chain data shows US-based investors are still selling, and the market remains choppy.

But if the exit queue keeps shrinking and entry demand stays strong, the selling pressure that’s weighed on ETH for months could finally fade. That might set the stage for a recovery—or at least a stabilization—heading into 2026.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.