In Brief

Bitcoin’s historic four-year cycle—characterized by halving-driven price surges culminating in speculative blow-off tops—has broken down in 2025, with the expected post-halving euphoria failing to materialize despite the April 2024 halving occurring on schedule.

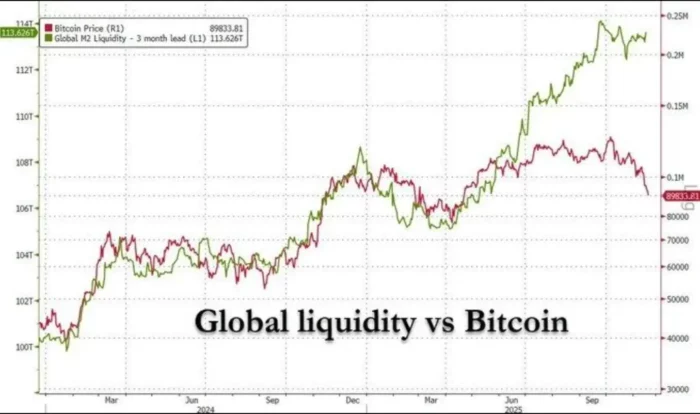

The previously strong correlation between Bitcoin and global liquidity has weakened significantly in recent months, suggesting the asset is transitioning from predictable cyclical patterns toward more complex macro-driven market structure influenced by multiple competing factors.

Economic indicators like the US Purchasing Managers’ Index (PMI) show unstable correlations with Bitcoin across different time periods, with the asset sometimes trading as “risk-on” during expansion and other times as “risk-off” hedge during uncertainty—demonstrating that no single indicator reliably predicts Bitcoin direction.

Sentiment has emerged as the dominant short-term price driver, explaining 20-40% of variance during normal conditions but potentially 60-70%+ during euphoric bull runs or panic crashes when emotional trading temporarily overrides fundamental and macro factors.

Michael Saylor’s declaration that the four-year cycle is “dead” reflects institutional recognition that Bitcoin’s maturation as an asset class means future cycles will center around economic cycles, Federal Reserve policy, and liquidity conditions rather than halving-driven retail speculation.

Bitcoin’s historically reliable four-year cycle—driven by halving events that reduced mining supply and triggered predictable price surges culminating in speculative blow-off tops—has definitively broken down in 2025. Despite the April 2024 halving occurring on schedule, the expected post-halving euphoria that characterized prior cycles has failed to materialize. Bitcoin prices declined 30% from early October highs rather than accelerating toward new all-time highs, and the broader altcoin market stalled without the “altcoin season” that typically follows Bitcoin strength. This breakdown represents more than temporary deviation—it signals fundamental transformation in how Bitcoin responds to market forces as institutional adoption reshapes the asset’s behavior. Understanding what replaces the four-year cycle requires examining why historical patterns no longer hold, which alternative frameworks investors are testing, and how sentiment dynamics now interact with macro conditions to drive short-term price discovery in an increasingly mature cryptocurrency market.

Historical Four-Year Cycle Structure and Why 2025 Represents Definitive Break

Bitcoin’s four-year cycle has operated with remarkable consistency since the asset’s 2009 inception. The pattern centered on halving events—programmed reductions in mining rewards that occur approximately every four years—which reduced new Bitcoin supply and historically triggered supply-demand imbalances that drove prices higher.

The cycle’s predictable structure followed a consistent progression: halving occurs, supply reduction creates scarcity narrative, prices begin gradual appreciation as early adopters accumulate, mainstream attention arrives as prices accelerate, retail participation surges creating speculative blow-off top roughly 12-18 months post-halving, followed by extended bear market until the next halving approaches.

This pattern repeated across three complete cycles: the 2012 halving preceded the 2013 blow-off top to $1,200, the 2016 halving preceded the 2017 surge to $20,000, and the 2020 halving preceded the 2021 peak near $69,000. Each cycle exhibited similar characteristics—extended accumulation phases, parabolic appreciation, speculative mania, and subsequent correction.

The history of Bitcoin bull market cycles has been a history of exponential decay. Agree with it or not, you will have to deal with it. Should the current decline carry to $50k, the next bull market cycle should carry to $200k to $250K pic.twitter.com/fFdgPPKvok

— Peter Brandt (@PeterLBrandt) December 1, 2025

The 2024 halving occurred in April as scheduled. Based on historical precedent, Bitcoin should have entered its parabolic phase by mid-2025, potentially reaching new all-time highs significantly above the $69,000 prior peak. Instead, Bitcoin peaked in early October 2025 before declining 30%—behavior that contradicts the historical post-halving trajectory.

The absence of blow-off top speculation particularly matters because altcoin seasons historically begin only after Bitcoin establishes sustained strength. When Bitcoin stagnates or declines, altcoins typically underperform even more dramatically. The stalled altcoin market in 2025 reflects this dynamic—without Bitcoin strength to drive sector-wide speculation, altcoins lack the momentum catalyst that previous cycles provided.

Global Liquidity Correlation Weakens, Challenging Primary Alternative Framework

As the four-year cycle’s predictive power declined, many analysts shifted focus toward global liquidity as the primary Bitcoin price driver. The thesis was straightforward: Bitcoin functions as a liquidity-sensitive asset that appreciates when central banks expand money supply and struggles when liquidity contracts.

Data from early 2024 initially supported this framework. Bitcoin prices tracked global liquidity measures closely throughout the first half of 2024, suggesting that monetary expansion rather than halving mechanics drove price appreciation. This correlation made intuitive sense—Bitcoin as a scarce digital asset should benefit when fiat currency supply expands.

However, recent months have seen this correlation break down significantly. Global liquidity has expanded while Bitcoin prices declined, contradicting the expected relationship. Similarly, periods of liquidity contraction haven’t uniformly triggered Bitcoin weakness. The breakdown suggests that liquidity influences Bitcoin but doesn’t determine price direction with the reliability that the four-year cycle once provided.

Michael Saylor, executive chairman of MicroStrategy and one of Bitcoin’s most prominent institutional advocates, recently declared the four-year cycle “dead.” Saylor’s positioning proves particularly notable given MicroStrategy’s aggressive Bitcoin accumulation throughout 2025—the company has acquired massive quantities despite the cycle breakdown, suggesting Saylor expects a “massive repricing” driven by factors other than halving mechanics.

With the PMI cooling off again, Bitcoin’s macro fair value has slipped back to around $140k.

2025 has been a choppy year for BTC.

Hot money has been stampeding toward faster horses: AI, gold, small caps… pretty much anything except Bitcoin.

But we haven’t seen BTC this far… https://t.co/Vxbi3Xlyqc pic.twitter.com/GlzpReWN4t

— mNAV.com (@BitcoinPowerLaw) December 1, 2025

Saylor’s thesis appears to center on institutional adoption fundamentally changing Bitcoin’s market structure. As institutions allocate capital based on portfolio theory, macro conditions, and regulatory developments rather than halving schedules, Bitcoin’s price drivers shift accordingly. The four-year cycle reflected retail-dominated markets where halving narratives drove speculation. Institutional markets respond to different catalysts.

Economic Indicators Show Unstable Correlations, Preventing Reliable Predictive Framework

With both the four-year cycle and global liquidity showing reduced predictive power, some analysts have explored relationships between Bitcoin and traditional economic indicators like the US Purchasing Managers’ Index (PMI). The PMI measures manufacturing sector health and functions as a leading economic indicator—readings above 50 suggest expansion, below 50 indicates contraction.

The theoretical relationship between PMI and Bitcoin operates through multiple channels. Strong PMI could signal robust economy, creating risk-on sentiment that favors speculative assets like Bitcoin. Conversely, weak PMI could trigger Federal Reserve easing, injecting liquidity that supports Bitcoin despite economic weakness. The challenge is that these channels operate in opposite directions—Bitcoin sometimes trades as risk-on asset during expansion and sometimes as risk-off hedge during uncertainty.

Data analysis reveals that correlations between Bitcoin and PMI are fundamentally unstable, varying dramatically across different time periods. Bitcoin doesn’t consistently respond to PMI signals the way equities or commodities typically do. Instead, Bitcoin’s response depends on the broader context—the specific reasons behind PMI changes, concurrent monetary policy, and crypto-specific factors unrelated to traditional economics.

Bitcoin responds more reliably to monetary policy signals—Federal Reserve decisions, liquidity conditions, interest rate expectations—than to real economy indicators like PMI. When PMI does appear to influence Bitcoin, it typically operates through the risk sentiment channel rather than direct mechanistic relationship. A strong PMI reading might increase Bitcoin demand if investors interpret it as signaling continued monetary accommodation, but the same reading could suppress Bitcoin if investors expect it to trigger Fed tightening.

This instability prevents PMI from serving as a reliable Bitcoin trading signal in the way the four-year cycle once did. Investors monitoring Fed policy, liquidity conditions, and crypto-native metrics like on-chain activity typically find more predictive value than economic indicators designed for traditional assets.

Sentiment Emerges as Dominant Short-Term Driver in Absence of Reliable Cyclical Framework

As traditional cyclical and macro frameworks prove inadequate for explaining Bitcoin’s post-cycle behavior, sentiment has emerged as the dominant short-term price driver. This development reflects Bitcoin’s unique characteristics as an asset lacking traditional valuation anchors.

Unlike equities (which can be valued through discounted cash flows), bonds (which have defined yields), or commodities (which have industrial demand), Bitcoin lacks fundamental metrics that establish intrinsic value. Price discovery relies primarily on what market participants believe the asset should be worth rather than objective valuation models. This creates space for sentiment to dominate in ways that would be impossible for traditional assets.

Academic studies examining cryptocurrency market behavior consistently demonstrate that social media activity, search trends, and news sentiment have measurable predictive power for short-term Bitcoin price movements—effects that exceed sentiment’s impact on traditional assets. The crypto market’s structural features amplify these sentiment effects: high retail participation leads to more emotional trading, 24/7 markets operate without circuit breakers that cool emotions, high leverage availability amplifies sentiment-driven moves, and rapid information dissemination through crypto-native social channels accelerates fear and greed cycles.

Quantifying sentiment’s role proves challenging because what appears as “pure sentiment” often includes assessments of fundamental factors. When investors grow excited about institutional adoption announcements, is that sentiment or recognition of changing supply-demand fundamentals? When macro concerns drive Bitcoin allocation as a hedge, sentiment functions as the transmission mechanism for macro factors rather than operating independently.

Research attempting to decompose Bitcoin returns generally finds that sentiment indicators explain approximately 20-40% of price variance during normal market conditions. However, this proportion spikes dramatically during extreme market phases—euphoric bull runs or panic crashes—when sentiment can dominate at 60-70%+ of price movement, temporarily overriding both fundamental and macro logic.

These extreme sentiment periods are when asset prices detach most dramatically from rational valuation models. Bitcoin’s history includes numerous examples: the late 2017 surge to $20,000 driven by retail FOMO, the March 2020 crash to $3,800 amid pandemic panic, and the 2021 rally to $69,000 fueled by retail and institutional speculation. In each case, sentiment overwhelmed rational analysis until exhaustion or capitulation reset market psychology.

Notably, cryptocurrency markets exhibit much stronger “momentum” and “herding” effects than traditional markets—behavioral patterns that typically indicate sentiment-driven trading. When Bitcoin begins appreciating, participants pile in expecting further gains regardless of fundamental justification. When Bitcoin declines, participants rush to exit expecting further losses. These self-reinforcing dynamics create volatility patterns distinct from traditional assets.

What Replaces the Four-Year Cycle: Multi-Factor Framework Without Dominant Signal

The breakdown of Bitcoin’s four-year cycle doesn’t mean Bitcoin becomes unpredictable—it means prediction requires monitoring multiple competing factors without relying on a single dominant signal.

The emerging framework suggests Bitcoin responds to several factors simultaneously:

Macro conditions (40% influence during stable periods) including Federal Reserve policy, inflation dynamics, dollar strength, and global liquidity conditions. These factors establish the broader environment that makes risk assets attractive or unattractive.

Supply-demand fundamentals (30% influence during stable periods) including adoption metrics, on-chain activity showing actual usage, exchange flows indicating accumulation or distribution, and long-term holder behavior. These factors determine whether organic demand supports current price levels.

Sentiment and speculation (30% influence during stable periods, 60-70%+ during extremes) including social media activity, retail participation, leverage usage, and narrative strength. These factors drive short-term volatility and create opportunities for rapid price movements disconnected from fundamentals.

During stable market periods, these factors coexist with none dominating completely. Bitcoin might appreciate modestly on improving macro conditions, decline on negative on-chain metrics, or trade sideways as competing signals offset. This creates a market environment where skillful analysis of multiple factors provides edge, but no single indicator guarantees predictive accuracy.

During extreme market phases—whether euphoric or panicked—sentiment overwhelms the other factors. Recognizing when markets enter sentiment-dominated phases becomes the critical skill, as traditional analysis loses predictive power until sentiment exhausts.

Individual Cryptocurrency Projects Face Distinct Dynamics Beyond Bitcoin’s Macro Integration

While Bitcoin’s cycle breakdown reflects its maturation and macro integration, individual cryptocurrency projects face different dynamics based on their specific use cases and development progress.

Projects building infrastructure, solving real-world problems, or creating genuine utility will rise and fall based on their execution, adoption metrics, and competitive positioning. These assets may exhibit cyclical behavior tied to Bitcoin’s direction during market-wide moves, but their long-term trajectories depend on fundamentals specific to their protocols and ecosystems.

Meme coins and purely speculative assets will continue exhibiting extreme volatility driven by short-lived attention cycles. These assets lack the institutional adoption and macro integration that now influence Bitcoin, making them more vulnerable to sentiment whiplash. Meme coin cycles operate on compressed timeframes—days or weeks rather than months or years—creating opportunities for rapid gains but also catastrophic losses when attention shifts.

The distinction between Bitcoin’s macro integration and altcoin speculation creates a bifurcated market where different assets require different analytical frameworks. Bitcoin increasingly trades as a macro asset influenced by Federal Reserve policy and institutional flows. Altcoins with genuine utility require fundamental analysis of adoption and development. Meme coins require understanding of social dynamics and attention economics.

Forward Outlook: Long-Term Demand Trajectory Remains While Short-Term Volatility Increases

Despite the four-year cycle breakdown and increased complexity in short-term price drivers, Bitcoin’s long-term demand trajectory appears intact. As Bitwise Chief Investment Officer Matt Houghton recently noted:

The reason bitcoin’s price is up ~28,000% over the last ten years is that more and more people want the ability to store digital wealth in a way that isn’t intermediated by a company or a government.

This fundamental demand driver—desire for non-sovereign store of value—hasn’t changed despite the cycle breakdown. What has changed is how that demand manifests in price action. Rather than predictable four-year boom-bust cycles, Bitcoin now exhibits the characteristics of a maturing asset class: increased correlation with macro conditions during risk-on/risk-off phases, reduced volatility compared to early years, institutional flows that stabilize rather than destabilize prices, and complex multi-factor dynamics that prevent simple cyclical prediction.

For investors, the cycle breakdown requires adaptation. Strategies that worked in prior cycles—buying after halvings, selling during blow-off tops, holding through predictable bear markets—may not work as reliably going forward. Instead, successful Bitcoin investment increasingly requires monitoring the same factors that determine traditional asset performance: central bank policy, liquidity conditions, institutional flows, and valuation relative to comparable assets.

The breakdown also suggests that “altcoin season”—the predictable phase where Bitcoin strength triggers speculative mania in smaller cryptocurrencies—may not occur in the same form as previous cycles. If Bitcoin appreciates gradually based on institutional adoption rather than exploding in retail-driven mania, the spillover effect into speculative altcoins may be muted. Altcoins will need their own catalysts rather than riding Bitcoin’s coattails.

The next Bitcoin rally—whenever it emerges—will likely look different from previous cycles. It may be driven by institutional allocation decisions rather than retail FOMO. It may occur during Federal Reserve easing rather than halving aftermath. It may be steadier and less volatile than previous blow-off tops. But the underlying demand for scarce digital assets with monetary properties suggests that appreciation will eventually resume, even if the path and timing differ from historical cycles.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.