Token Unlocks Inject $312 Million New Supply in First Week of November Led by ENA, MEME, MOVE

In Brief

Token unlocks totaling over $312 million hit markets during first week of November 2025, with Ethena, Memecoin, and Movement representing largest individual releases.

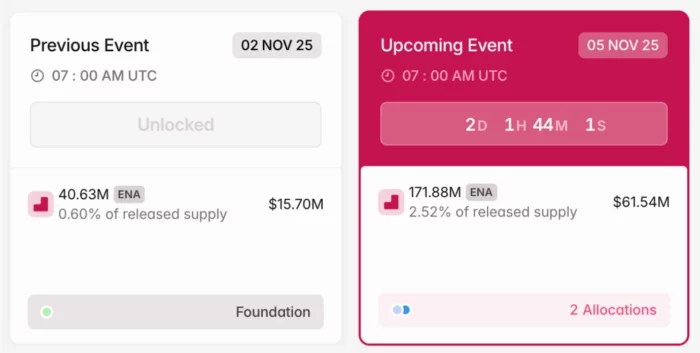

Ethena unlocks 171.88 million ENA tokens worth $61.54 million on November 5, split between core contributors (93.75M) and investors (78.13M) representing 2.52% of circulating supply.

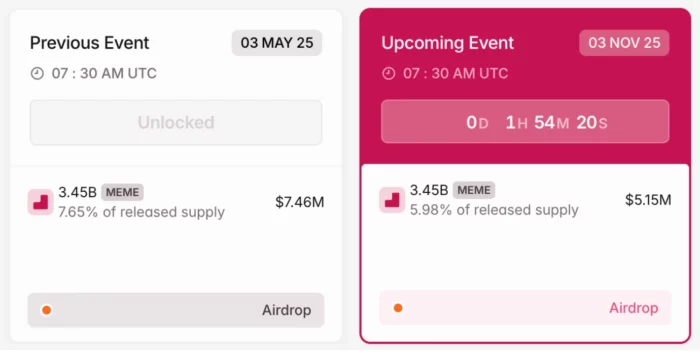

Memecoin releases 3.45 billion MEME tokens valued at $5.15 million on November 3, accounting for 5.98% of released supply with entire allocation reserved for airdrops.

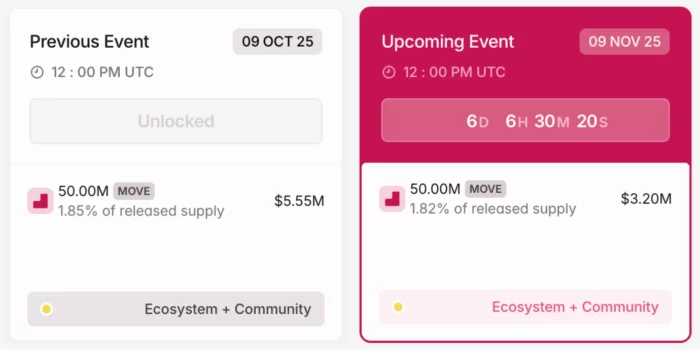

Movement unlocks 50 million MOVE tokens worth $3.2 million on November 9, representing 1.89% of circulating supply with full allocation to ecosystem and community initiatives.

Additional unlocks from BounceBit, RedStone, and Space and Time contribute to weekly supply expansion creating heightened volatility risk across affected tokens.

Token unlocks exceeding $312 million in aggregate value will inject new supply into cryptocurrency markets during the first week of November 2025, with three major projects—Ethena, Memecoin, and Movement—executing the largest individual releases. These scheduled supply expansions represent programmatic token distribution events that can significantly impact price dynamics as newly liquid tokens enter circulation and become available for trading or selling by recipients including team members, investors, and ecosystem participants.

The concentration of multiple large unlocks within a single week creates compounded volatility risk, as markets must simultaneously absorb new supply across several tokens while participants adjust positions in anticipation of or reaction to the increased selling pressure that unlocks typically generate.

Understanding Token Unlock Mechanics and Market Impact

Token unlocks represent scheduled events where previously locked or vested tokens become liquid and transferable, allowing recipients to trade, sell, or deploy these assets as they choose. Projects typically implement vesting schedules and lock-up periods for team allocations, investor tokens, and ecosystem reserves to prevent immediate massive selling that would crash prices at launch and to align long-term incentives among stakeholders.

The market impact of unlocks depends on several factors including the absolute quantity of tokens released, the percentage they represent of current circulating supply, the identity of recipients, and prevailing market conditions. Unlocks releasing 1-2% of circulating supply typically generate manageable price pressure, while releases exceeding 5% often trigger substantial volatility as markets struggle to absorb the new supply.

Recipient identity matters because different stakeholders face different incentives regarding whether to hold or sell newly unlocked tokens. Team members and long-term investors may retain positions if they maintain conviction in project fundamentals, while early-stage venture investors who achieved substantial paper returns might view unlocks as liquidity events justifying profit-taking. Ecosystem and community allocations depend on how projects deploy these tokens—whether through staking rewards, liquidity mining, grants, or other distribution mechanisms.

Market conditions at unlock timing significantly influence actual selling pressure. During bull markets or periods of strong project-specific momentum, recipients often hold unlocked tokens expecting further appreciation. During bear markets or periods of project weakness, unlocks frequently trigger selling as recipients prioritize liquidity over uncertain future gains.

Ethena: Largest Dollar-Value Unlock at $61.54 Million

Ethena executes the week’s largest unlock by dollar value on November 5, releasing 171.88 million ENA tokens worth approximately $61.54 million at current prices. This represents 1.15% of Ethena’s 15 billion total token supply but a more meaningful 2.52% of the current 7.15 billion circulating supply—the metric that directly impacts market dynamics since it measures dilution relative to actively traded tokens.

The allocation breakdown reveals 93.75 million tokens designated for core contributors and 78.13 million for investors. This split creates mixed incentive structures where team members receiving the majority allocation may hold tokens to maintain alignment with project success, while investor allocation allows early backers to realize returns through partial or complete liquidation.

Ethena operates as a decentralized synthetic dollar protocol built on Ethereum, offering crypto-native alternatives to traditional stablecoins through its USDe product. The governance token ENA has established itself in the competitive stablecoin infrastructure space, though the project faces ongoing challenges differentiating from established players like Circle’s USDC and Tether’s USDT.

The November 5 unlock follows Ethena’s pattern of “cliff unlocks”—large one-time releases rather than gradual linear vesting. This approach concentrates supply impact into specific dates rather than spreading it across time, creating predictable volatility windows that traders can position around. The protocol recently executed another unlock on November 2, releasing 40.63 million ENA entirely to the Foundation, indicating active ongoing token distribution beyond this week’s event.

Historical Context and Price Sensitivity

Ethena’s previous unlocks provide context for anticipating market response to the November 5 event. If past unlocks triggered substantial selling pressure that depressed prices for days or weeks afterward, similar dynamics likely recur unless project fundamentals have strengthened materially. Conversely, if previous unlocks were absorbed with minimal impact, it suggests either strong holder conviction or effective market-making support that could similarly cushion this release.

The 2.52% dilution rate sits in the moderate range where impact depends heavily on trading volume and liquidity depth. In low-volume conditions, even 2% supply expansion can overwhelm bid-side liquidity and trigger sharp declines. In high-volume environments with deep order books, markets often absorb similar dilution with minimal lasting impact.

The timing less than two months after the previous Foundation-directed unlock on November 2 creates cumulative dilution concerns, as markets haven’t had extended periods to absorb previous supply before confronting new releases. This compressed timeline between unlocks increases probability that selling pressure from the November 5 event will be more pronounced.

Memecoin: Highest Percentage Dilution at 5.98%

Memecoin executes the week’s highest percentage dilution on November 3, releasing 3.45 billion MEME tokens that represent 5.98% of current circulating supply despite the relatively modest $5.15 million dollar value. This percentage substantially exceeds the 1-2% threshold where unlocks typically generate manageable impact, placing it in the range where significant price pressure should be anticipated.

The project characterizes itself as “a community-driven meme token that embodies the spirit of internet culture, offering no utility, roadmap, or promises of financial return”—a remarkably transparent acknowledgment that MEME exists purely as speculative vehicle without fundamental value drivers. This positioning creates unique dynamics around unlocks since holders cannot justify positions based on utility or revenue generation but rather on meme momentum and community enthusiasm.

The entire 3.45 billion token unlock is designated for airdrops rather than going to team or investors. This allocation strategy aims to expand token distribution and potentially grow the community, though it also guarantees that all unlocked tokens will reach recipients who made no capital commitment to acquire them. Airdrop recipients historically demonstrate lower holding conviction than purchasers or investors, often selling immediately upon receipt to capture free value.

Meme Token Dynamics and Unlock Sensitivity

Meme tokens demonstrate particularly high sensitivity to unlocks because their valuations depend entirely on sustained community enthusiasm and new participant entry rather than fundamental value accrual. When significant new supply enters markets, the narrative of scarcity that often drives meme token appreciation becomes harder to maintain, potentially triggering momentum reversal.

The 5.98% dilution rate represents substantial supply shock that could overwhelm buying interest unless coordinated by market makers or the project itself. With 58.77 billion MEME already circulating from the 69 billion total supply, the token approaches full dilution with only 15% remaining locked. This advanced dilution stage means the November 3 unlock represents one of the final major supply expansions before full circulation is reached.

The airdrop designation suggests the project prioritizes community growth and distribution over protecting token price. While this approach can build larger holder base and potentially attract new participants, it also ensures that a significant portion of recipients will likely sell immediately, creating concentrated selling pressure on or shortly after November 3.

Movement: Modest Ecosystem-Focused Release

Movement executes the smallest unlock by both dollar value ($3.2 million) and percentage of circulating supply (1.89%) on November 9, releasing 50 million MOVE tokens with the entire allocation designated for ecosystem and community initiatives. This structure suggests the tokens will be deployed through grants, development incentives, liquidity mining, or similar programs rather than immediately flooding secondary markets.

The project leverages Meta’s Move programming language to enable high-performance, secure application development through MoveVM, positioning itself in the competitive Layer-1 and developer platform space. The emphasis on Move language—originally developed for Facebook’s now-defunct Libra/Diem project—represents technical differentiation from EVM-compatible chains that dominate the smart contract landscape.

The ecosystem and community allocation reduces immediate selling pressure compared to team or investor unlocks, as these tokens typically deploy over time through programmatic distribution rather than going directly to recipients who might liquidate immediately. However, it does represent real dilution that adds to circulating supply and eventually reaches end recipients who face no restrictions on subsequent selling.

Lower Risk Profile From Allocation Structure

Movement’s 1.89% dilution rate and ecosystem allocation create the lowest-risk profile among the three featured unlocks. The percentage falls below the 2% threshold where markets typically absorb new supply without substantial lasting impact, while the allocation structure suggests gradual deployment rather than immediate liquidity event.

With only 2.8 billion of 10 billion total MOVE tokens currently circulating, the project remains in relatively early dilution stages where 72% of supply remains locked. This positioning means the November 9 unlock represents one of many future releases as the token gradually approaches full circulation over coming quarters or years.

The timing on November 9—latest among the three featured unlocks—means Movement benefits from markets having already absorbed the Ethena and Memecoin supply before confronting MOVE dilution. If the earlier unlocks trigger broader selling pressure or risk-off sentiment toward tokens facing supply events, Movement could experience collateral impact despite its modest individual dilution.

Additional Unlocks Compound Weekly Supply Pressure

Beyond the three featured tokens, additional projects including BounceBit (BB), RedStone (RED), and Space and Time (SXT) will also execute unlocks during the first week of November, contributing to the aggregate $312 million supply expansion. While individually smaller than Ethena, Memecoin, or Movement releases, these additional unlocks compound overall market impact by creating multiple simultaneous selling pressure sources.

The concentration of unlocks within a single week appears partly coincidental—projects typically schedule unlocks based on launch dates and vesting terms that align to monthly or quarterly intervals—but creates a challenging environment for capital absorption. Markets must simultaneously digest new supply across multiple tokens while existing holders potentially rotate capital defensively in anticipation of or reaction to dilution events.

This clustering effect can create negative feedback loops where unlock-driven selling in one token triggers risk-off positioning across others facing similar events, amplifying price impact beyond what individual unlock sizes would suggest. Conversely, if markets absorb early-week unlocks cleanly, it can build confidence that subsequent releases will similarly prove manageable.

Trading Strategies Around Token Unlocks

Market participants employ various strategies to navigate token unlock events depending on their time horizons, risk tolerance, and conviction in affected projects. Understanding these approaches provides context for anticipating price action before, during, and after unlock dates.

Pre-unlock selling involves liquidating positions days or weeks before scheduled releases to avoid anticipated price pressure. This defensive approach accepts missing potential upside if unlocks are absorbed cleanly in exchange for avoiding downside if selling pressure materializes. The strategy proves most effective when many participants employ it, creating self-fulfilling price weakness ahead of unlocks.

Post-unlock buying targets the price dislocation and oversold conditions that often follow major releases after initial selling exhausts. This contrarian approach requires patience to wait for capitulation and conviction that the selling represents temporary technical pressure rather than fundamental deterioration. Success depends on accurately timing the bottom after unlock-driven decline.

Active trading around volatility involves positioning to profit from expected price swings regardless of direction, using options strategies, tight stop losses, or quick reversal trades. This approach requires close monitoring and rapid execution but can generate returns from the heightened volatility that unlocks create.

Long-term holding through unlocks ignores short-term dilution in favor of maintaining positions based on fundamental conviction that projects will succeed regardless of temporary supply pressure. This approach makes sense for high-conviction positions in projects with strong fundamentals where unlocks represent known events already priced into long-term valuation expectations.

Risk Factors and Considerations

Several factors could amplify or mitigate the expected price pressure from these unlocks beyond the baseline impact suggested by supply expansion percentages. Broader cryptocurrency market conditions significantly influence how markets absorb new supply—bull market enthusiasm can easily digest unlocks that would trigger sharp declines during bear market pessimism.

Project-specific developments around unlock timing can either offset or amplify supply pressure. Positive announcements, partnership reveals, or product launches timed to coincide with unlocks can generate buying interest that absorbs new supply. Conversely, negative news, delays, or competitive challenges amplify unlock pressure.

Recipient behavior varies based on individual circumstances, market views, and tax considerations. Not all unlocked tokens immediately reach markets—some recipients hold indefinitely, others sell gradually to avoid moving markets, while some liquidate immediately. The actual selling pressure often emerges over days or weeks following unlocks rather than concentrating on release date itself.

Market maker activity and project treasury operations can significantly influence price impact through active support. Projects with substantial resources sometimes deploy capital to provide bid support during unlocks, cushioning price impact in exchange for accumulating their own tokens at depressed levels. The extent of such support varies dramatically across projects based on treasury size, strategy, and price maintenance priorities.

What to Monitor During Unlock Week

Several specific metrics and price action characteristics will indicate whether these unlocks are being absorbed cleanly or triggering the anticipated selling pressure. Trading volume provides the first signal—substantially elevated volume accompanying unlocks suggests active selling is occurring, while normal or below-average volume indicates recipients are largely holding rather than liquidating.

Price action relative to unlock timing reveals market positioning and expectations. Weakness in the days leading up to releases suggests pre-unlock defensive selling, while strength indicates confidence the events will be absorbed. Post-unlock price behavior shows whether initial selling exhausts quickly allowing recovery or whether pressure persists as recipients continue liquidating over subsequent days.

Exchange inflow data—tracking tokens moving from wallets to exchanges where they can be sold—provides direct observation of recipient behavior. Large inflows to exchanges following unlocks confirm selling intentions, while tokens remaining in wallets or moving to DeFi protocols suggests recipients plan to hold or deploy tokens productively rather than liquidate.

Relative performance versus broader markets indicates whether weakness stems from unlock-specific selling or general market conditions. Tokens significantly underperforming Bitcoin and major altcoins during unlock periods point to dilution impact, while similar or better performance suggests the supply was absorbed without exceptional pressure.

For the first week of November 2025, close attention to these metrics across Ethena, Memecoin, Movement, and the additional unlocking projects will reveal whether the concentrated $312 million supply expansion creates the anticipated volatility and price pressure or whether strong market conditions and holder conviction allow clean absorption with minimal lasting impact.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.