Stablecoin Payments Surge 70% as Corporate Adoption Drives $10 Billion Monthly Volume

In Brief

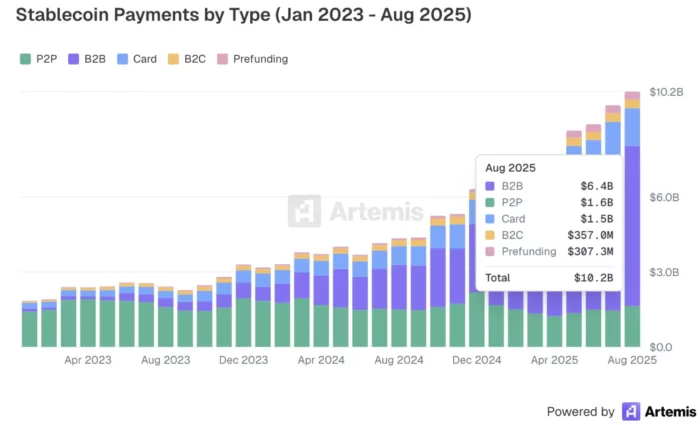

Stablecoin payments jumped 70% from $6 billion in February to over $10 billion by August 2025, driven primarily by corporate adoption.

Business-to-business transfers now account for nearly two-thirds of payment volume, rising 113% to $6.4 billion monthly.

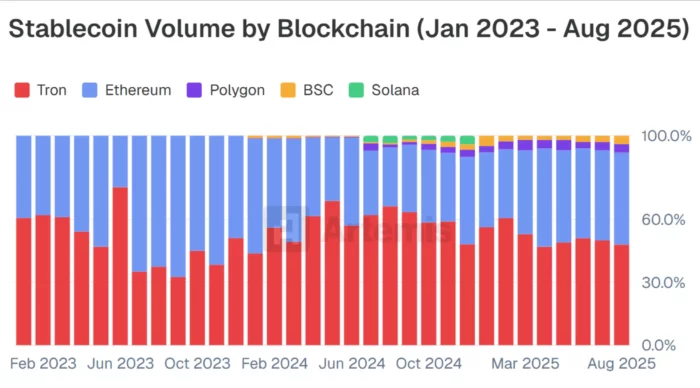

Tron’s blockchain dominance eroded from 66% market share in late 2024 to 48% by August as Base, Solana, and other networks capture volume.

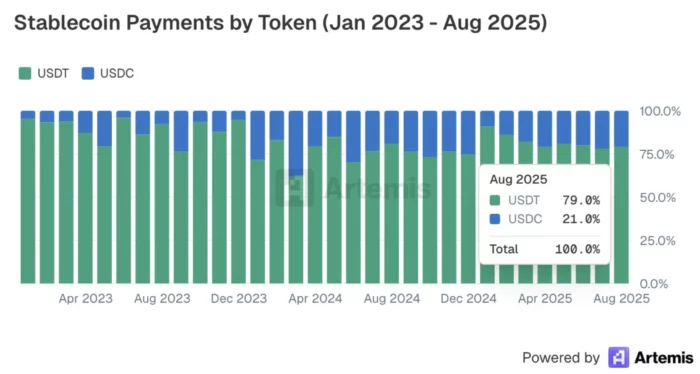

Tether’s USDT maintains 79% of payment volume with $183 billion market cap, while Circle’s USDC expanded from 14% to 21% share.

Cumulative stablecoin payment value since 2023 surpassed $136 billion, signaling transition from trading tools to mainstream payment infrastructure.

Stablecoin payments have accelerated dramatically through 2025, with settlement volumes climbing 70% as digital dollars transition from primarily serving crypto traders to functioning as legitimate payment infrastructure for corporate transactions. Monthly volume exceeded $10 billion by August after starting the year at $6 billion, according to data from Artemis, marking the most substantial growth period for stablecoin-based commerce since these assets emerged.

The expansion reveals a fundamental shift in how businesses and consumers utilize blockchain-based dollars, with corporate adoption outpacing retail usage and established networks facing competitive pressure from newer, faster alternatives.

Corporate Transfers Dominate Growth Trajectory

Business-to-business transactions have emerged as the primary driver behind stablecoin payment expansion, now representing nearly two-thirds of total settlement volume. Monthly B2B transfers more than doubled since February, surging 113% to approximately $6.4 billion—a growth rate that significantly outpaces consumer-facing usage.

This corporate adoption pattern indicates stablecoins are fulfilling their intended purpose as efficient settlement mechanisms for business transactions rather than remaining confined to crypto-native activities like exchange transfers or DeFi protocols. Companies are discovering that stablecoin rails offer material advantages over traditional payment systems for certain transaction types.

Chart by Artemis

The appeal centers on settlement speed and cost reduction. Traditional cross-border B2B payments often require multiple days to clear through correspondent banking networks, with fees consuming 3-7% of transaction value depending on corridors and intermediaries involved. Stablecoin transfers settle within minutes at fractions of traditional costs, making them particularly attractive for international business relationships.

Cumulative payment value since 2023 has surpassed $136 billion across all stablecoin transactions, demonstrating sustained rather than temporary adoption. This figure represents actual commerce and business operations rather than speculative trading volume, as payment-focused metrics specifically exclude exchange transfers and on-chain trading activity.

The B2B dominance suggests stablecoins have crossed a critical threshold where businesses trust these instruments sufficiently to integrate them into core payment operations. This represents a qualitative shift from experimental pilot programs to production-grade infrastructure supporting real business relationships.

Consumer Channels Show Parallel Expansion

While corporate adoption leads growth metrics, consumer-facing stablecoin payments are following a similar upward trajectory across multiple channels. Card-based crypto payments increased approximately 36% during the reporting period, indicating retail users are finding practical applications for spending digital assets in everyday transactions.

Business-to-consumer transactions grew 32%, reflecting merchants’ willingness to accept stablecoin payments directly rather than requiring conversion to traditional currency. This adoption pattern suggests retailers see value in accepting digital dollars despite the operational complexity of integrating new payment rails.

Prefunding mechanisms—where merchants maintain stablecoin liquidity to ensure instant settlement—jumped 61% during the same timeframe. This metric is particularly revealing because it demonstrates merchants are committing working capital to stablecoin positions rather than immediately converting to fiat, signaling confidence in the assets’ stability and utility.

Crypto card payment volume now processes more than $1.5 billion monthly, representing 50% year-to-date growth according to industry participants. These cards function by allowing users to spend stablecoin or cryptocurrency holdings at any merchant accepting traditional payment networks, with real-time conversion happening at point of sale.

David Alexander, partner at venture firm Anagram, highlighted how this infrastructure enables novel financial behaviors. Users can maintain assets in yield-generating DeFi protocols while retaining the ability to spend those funds immediately through traditional payment channels, effectively merging blockchain-based yield opportunities with conventional commerce.

“One of the earliest use cases for stablecoins was simple peer-to-peer transfers. The appeal was sending money faster and cheaper, and making fiat more accessible, particularly for regions with limited access to traditional forms of banking. But that’s where the path of onchain money traditionally ended: users couldn’t spend it offchain. Now, that same money has evolved into programmable capital: assets that live onchain, earn yield, and function as direct equivalents to traditional payment instruments, usable anywhere in the world,” Alexander explained.

This evolution from simple peer-to-peer transfers to programmable capital represents the maturation of stablecoin utility beyond their initial value proposition.

Chart by Artemis

Network Competition Intensifies as Tron Loses Ground

The blockchain infrastructure supporting stablecoin payments is undergoing significant competitive realignment, with Tron’s dominant position eroding as newer networks capture market share. While Tron remains the largest single blockchain for stablecoin settlement, its dominance has declined sharply from 66% in late 2024 to 48% by August 2025.

This 18 percentage-point decline represents substantial volume migrating to alternative networks that offer different trade-offs around speed, cost, and ecosystem integration. Base, Codex, Plasma, and Solana have emerged as the primary beneficiaries, collectively capturing the share Tron surrendered.

The shift reflects both technical and economic factors. Tron built early dominance through extremely low transaction fees and high throughput, making it attractive for stablecoin transfers when other networks charged higher gas fees. However, newer layer-2 solutions and optimized blockchains now match or exceed Tron’s cost advantages while offering superior developer ecosystems and institutional support.

Omar Kanji, partner at Dragonfly, characterized this as “the beginning of a structural rotation” where lower-cost and high-throughput alternatives gradually erode Tron’s market position. The language suggests this isn’t temporary volatility but rather a fundamental reordering of which networks capture stablecoin settlement activity.

The competitive dynamics matter because network effects typically create winner-take-most outcomes in payment infrastructure. If users, merchants, and businesses consolidate around specific blockchains for stablecoin activity, those networks gain liquidity advantages that become self-reinforcing. Tron’s declining share indicates these network effects may be weakening or that multiple networks can coexist with specialized niches.

For payment processors and businesses integrating stablecoin rails, this fragmentation creates integration complexity. Supporting multiple blockchains requires separate technical implementations and liquidity management across chains, increasing operational overhead compared to scenarios where one or two networks dominate.

Tether Maintains Dominance While Circle Gains Ground

At the asset level, Tether’s USDT continues commanding the stablecoin payment ecosystem with approximately 79% of all settlement volume. This dominance stems from USDT’s deep liquidity across global markets and particularly strong adoption throughout Africa and Latin America, where access to dollar-denominated accounts remains limited.

USDT’s entrenchment in emerging markets reflects its early mover advantage and Tether’s focus on building distribution in regions underserved by traditional banking. For users in countries experiencing currency instability or capital controls, USDT provides dollar exposure without requiring international bank accounts—a compelling value proposition that drives sustained adoption.

However, Circle’s USDC has quietly expanded its footprint, with payment volume share rising from 14% to 21% since February. This seven percentage-point gain represents substantial absolute volume given the overall market’s 70% growth during the same period. USDC’s expansion suggests it’s capturing disproportionate share of new payment activity rather than merely growing proportionally with the overall market.

The competitive dynamics between USDT and USDC reflect different regulatory postures and institutional positioning. USDC maintains stronger regulatory compliance frameworks and transparency around reserves, making it preferred by institutions requiring clear audit trails and regulatory clarity. USDT offers broader accessibility and deeper liquidity, making it preferred for actual commerce in regions where regulatory compliance matters less than practical utility.

Current market capitalizations underscore the scale of these stablecoin networks. USDT stands at approximately $183 billion while USDC approaches $76 billion, together anchoring a $300-billion ecosystem of blockchain-based dollars. These figures represent genuine economic value rather than inflated market caps from speculative assets, as stablecoins maintain stable dollar pegs by design.

What Growth Reveals About Crypto’s Maturation

The stablecoin payment surge carries implications beyond simple volume metrics, revealing how cryptocurrency infrastructure is maturing from speculative vehicle to functional payment system. Several characteristics of current growth patterns signal this transition.

First, B2B adoption leading consumer usage indicates businesses see concrete operational advantages rather than merely experimenting with novel technology. Companies don’t integrate new payment rails for publicity—they do so when those rails deliver measurable improvements in cost, speed, or reach.

Second, the growth is sustained across multiple quarters rather than representing a brief spike. The climb from $6 billion to $10 billion monthly occurred steadily across six months, suggesting underlying demand rather than temporary enthusiasm.

Third, multiple use cases are expanding simultaneously—B2B transfers, consumer cards, merchant prefunding, B2C transactions—indicating broad-based adoption rather than concentration in niche applications. This diversification reduces vulnerability to any single use case losing traction.

Fourth, network competition is intensifying based on performance characteristics like cost and speed rather than speculative narratives. When users migrate from Tron to Base or Solana based on transaction economics and ecosystem quality, it signals market maturation toward practical considerations.

Chart by Artemis

Regulatory Considerations Loom Large

The expansion of stablecoin payments to $10 billion monthly and $136 billion cumulative inevitably attracts regulatory attention as these volumes approach scales where systemic importance becomes relevant. Multiple jurisdictions are developing or implementing stablecoin regulatory frameworks that will shape how these payment systems evolve.

The European Union’s Markets in Crypto-Assets (MiCA) regulation establishes comprehensive rules for stablecoin issuers operating in EU markets. United States regulators continue debating appropriate frameworks, with various proposals addressing reserve requirements, redemption rights, and systemic risk management.

How these regulations develop will determine whether stablecoin payments continue their current growth trajectory or face constraints that redirect activity toward compliant alternatives. Issuers and payment processors are already adapting operations to anticipated regulatory requirements, but uncertainty remains around final rule structures.

The B2B payment dominance could accelerate regulatory clarity, as corporate adoption requires legal certainty that individual users might tolerate ambiguity around. Businesses integrating stablecoins into accounts payable and receivable processes need confidence that regulatory changes won’t disrupt operations or create unexpected liabilities.

Infrastructure Implications and Future Trajectory

Sustaining 70% growth rates requires continued infrastructure development across multiple layers. Blockchain networks must scale to accommodate growing transaction volumes without degrading performance or increasing costs. Payment processors need robust systems for handling volatility, managing liquidity across chains, and ensuring regulatory compliance.

The shift from Tron toward multiple competing networks creates both opportunities and challenges. Increased competition should drive innovation and reduce costs, but fragmentation could hinder the network effects necessary for mainstream adoption. Whether the market consolidates around a few dominant chains or maintains a multi-chain equilibrium will significantly impact user experience and business integration complexity.

The current trajectory suggests stablecoin payments could exceed $15 billion monthly by year-end if growth rates persist, representing a credible challenge to traditional payment rails for specific use cases. However, reaching mass-market scale comparable to card networks processing trillions annually requires continued evolution in user experience, regulatory clarity, and business adoption.

For now, the $10 billion monthly milestone and 70% growth rate demonstrate that stablecoins have successfully transitioned from crypto-trading instruments to legitimate payment infrastructure supporting real economic activity. Whether this foundation supports continued exponential growth or represents a plateau before the next phase depends on how infrastructure, regulation, and adoption dynamics evolve through the remainder of 2025.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.