Bitcoin Price Could Rally on “Debasement Trade” Narrative as 2026’s Dominant Investment Thesis

In Brief

Bitcoin price narrative shifting toward “debasement trade” theory positioning BTC as hedge against fiat currency dilution from expanding money supply and government debt.

Bitwise CIO Matt Hougan predicts debasement trade concept will dominate crypto discourse into 2026 as distrust in government-backed assets intensifies.

M2 money supply jumped from $15 trillion to over $20 trillion since 2020 pandemic stimulus, fueling rotation into scarce assets including Bitcoin and gold.

Bitcoin’s 50% price gain over past year despite weekly volatility demonstrates resilience amid macro uncertainty and policy-driven market swings.

Fixed 21 million coin supply and central bank independence position Bitcoin as “digital hard asset” similar to gold for wealth preservation strategy.

Bitcoin price could benefit from an emerging narrative positioning the cryptocurrency as the primary hedge against currency debasement—the declining purchasing power of fiat money resulting from expanding government debt and monetary stimulus. The “debasement trade” framework, which Bitwise CIO Matt Hougan predicts will dominate crypto discourse through 2026, represents a return to Bitcoin’s foundational value proposition as an alternative to traditional monetary systems that many observers believe are increasingly unstable.

This narrative shift comes as global debt levels reach historic highs, inflation concerns persist despite central bank interventions, and policy volatility creates uncertainty around the stability of government-backed assets including bonds and fiat currencies. The framework positions Bitcoin alongside gold as a “hard asset” whose scarcity provides protection when trust in traditional money weakens.

Understanding the Debasement Trade Framework

The debasement trade theory in Bitcoin contexts refers to investment strategies positioning the cryptocurrency as protection against the declining value of fiat currencies through monetary expansion. When governments expand money supply through debt issuance, quantitative easing, or direct monetary stimulus, each unit of currency loses purchasing power relative to goods, services, and scarce assets—a process economists term currency debasement.

Bitcoin’s fixed supply cap of 21 million coins—encoded in the protocol and unchangeable without network-wide consensus that has never materialized despite various attempts—creates mathematical scarcity that contrasts sharply with fiat currencies whose supply central banks can expand at discretion. This fundamental difference positions Bitcoin as a hedge against monetary dilution in the same category as gold, real estate, or other assets with supply constraints.

The framework treats Bitcoin as a “digital hard asset” that preserves value when trust in traditional monetary systems weakens. Unlike physical gold, Bitcoin offers advantages including divisibility, portability across borders through digital transfer, and verifiable scarcity through transparent blockchain ledgers that anyone can audit. These characteristics make it attractive to investors seeking alternatives to assets whose value depends on government and central bank credibility.

The debasement trade has gained momentum as global sovereign debt reaches levels historically associated with either default or inflation—creating scenarios where governments face difficult choices between explicit default that destroys bondholder value or implicit default through inflation that erodes currency purchasing power. Neither outcome supports confidence in government-backed financial instruments, driving interest in alternatives outside traditional financial systems.

Bitcoin’s Genesis as Response to Financial Crisis

The debasement trade narrative aligns closely with Bitcoin’s original purpose as articulated in its genesis block and early community discussions. Satoshi Nakamoto launched Bitcoin in January 2009 against the backdrop of the 2008 financial crisis, with the genesis block containing a timestamp reference to a Times of London headline: “Chancellor on brink of second bailout for banks.”

This embedded message wasn’t accidental decoration but rather a deliberate statement about Bitcoin’s purpose as alternative to financial systems requiring government intervention to prevent collapse. The reference captured the moment when governments worldwide deployed unprecedented monetary stimulus and bank bailouts to prevent systemic failure—precisely the conditions that erode trust in traditional money and create demand for alternatives.

Andrew Tu, executive at crypto market maker Efficient Frontier, observes that Bitcoin’s fundamental thesis always incorporated debasement concerns. “I think that BTC’s fundamental thesis was always some variation of the debasement trade. Starting from the genesis block in which Satoshi references the bailout for banks,” he noted, connecting contemporary debasement narratives to Bitcoin’s founding principles.

This historical context matters because it establishes that the debasement trade isn’t a new narrative imposed retrospectively on Bitcoin but rather represents return to the cryptocurrency’s core value proposition after years where other narratives—including digital payments, programmable money, or simply speculation—dominated discourse. The renewed emphasis on debasement represents philosophical return to origins rather than narrative innovation.

Money Supply Expansion Validates Debasement Concerns

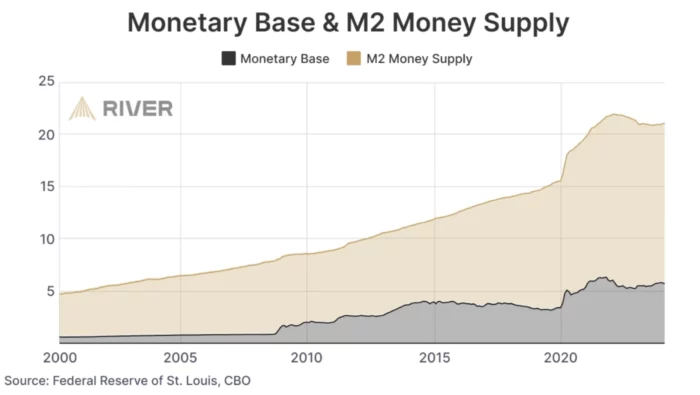

Empirical data on money supply growth since 2020 provides concrete foundation for debasement concerns that might otherwise appear abstract or theoretical. The M2 money supply measure—which includes cash, checking deposits, savings accounts, and other near-money instruments—jumped from approximately $15 trillion to over $20 trillion in the United States following pandemic-era stimulus programs.

This 33% expansion in money supply within roughly two years represents one of the most dramatic peacetime monetary expansions in modern history, comparable in magnitude to wartime financing but occurring during economic circumstances that, while severe, didn’t approach existential national threats that historically justified such measures. The speed and scale of expansion exceeded even 2008 financial crisis responses.

The mechanism connecting money supply expansion to Bitcoin demand operates through multiple channels. Most directly, increased fiat supply reduces each currency unit’s purchasing power, creating incentive to hold assets whose supply doesn’t expand proportionally. Bitcoin’s fixed supply makes it attractive precisely because no entity can respond to demand by creating additional supply—the scarcity remains absolute regardless of price increases.

Additionally, cheap and abundant money creates conditions favoring risk asset appreciation as investors seek returns exceeding near-zero interest rates on cash and government bonds. Bitcoin benefited enormously from this dynamic, rising from approximately $4,000 during March 2020 lockdowns to current levels above $100,000—a 25x increase that substantially outpaced money supply growth but correlates clearly with the timing of monetary expansion.

Tu notes this relationship explicitly:

“BTC with its hard supply cap has always been seen by Bitcoiners as a hedge against the fiat system that we currently have.”

The fixed supply cap creates mathematical certainty about scarcity that no assurances from central banks regarding prudent monetary policy can match, providing appeal to those skeptical of institutional commitments.

Source: Coingecko

Policy Volatility Amplifies Debasement Appeal

Beyond secular trends in money supply expansion, short-term policy volatility under the Trump administration has created conditions where investors increasingly view government policy as unpredictable risk factor requiring hedging rather than stable backdrop for investment decisions. Sudden tariff announcements, abrupt reversals, and market-moving policy declarations via social media create uncertainty that undermines confidence in policy continuity.

The October 10 market crash triggered by tariff fears exemplifies this dynamic—a sharp selloff based not on economic fundamentals deteriorating but rather on policy announcement. While recovery proved swift, the episode demonstrated how dependent markets have become on political decisions that can shift rapidly. This dependency creates uncomfortable realization among investors that traditional safe assets including government bonds may carry more political risk than previously recognized.

Bitcoin’s independence from political decision-making provides appeal in this environment. While cryptocurrency prices certainly respond to policy developments affecting regulatory treatment or macroeconomic conditions, the Bitcoin protocol itself operates outside political control. No presidential announcement can change Bitcoin’s supply schedule, no central bank meeting can adjust its monetary policy, no legislative vote can modify its fundamental characteristics.

This political independence becomes particularly valuable when policy volatility reaches levels where traditional hedging strategies prove inadequate. Currency diversification offers limited protection when all major fiat currencies face similar expansion pressures. Government bonds provide safety only to the extent governments remain creditworthy—an assumption increasingly questioned as debt levels rise. Gold offers traditional inflation hedge but faces potential confiscation or ownership restrictions that governments have historically imposed during crises.

Bitcoin’s 50% Annual Gain Despite Volatility

Bitcoin price has risen approximately 50% over the past year despite substantial week-to-week volatility—a performance demonstrating resilience that supports positioning the asset as legitimate store of value rather than purely speculative vehicle. This gain occurred against a backdrop of repeated concerns about recession, bear market probability, and various crisis scenarios that analysts predicted throughout 2023-2025.

Jeff Emery, Managing Partner at Globe 3 Capital, observes the disconnect between persistent bearish economic forecasts and actual market performance. “Despite all of the uncertainty and economists saying a recession and/or bear market was extremely likely in 2023, most likely in 2024, and 50/50 in 2025. It’s too early to call right now, but we are expecting to call for another bull market year in 2026,” he noted, highlighting how markets have defied conventional wisdom.

The volatility itself serves dual functions in the debasement narrative. For long-term holders focused on Bitcoin as inflation hedge, week-to-week price swings represent noise around secular appreciation trend driven by fixed supply meeting growing demand. The 50% annual gain matters more than the path taken to achieve it, similar to how gold’s long-term store of value function persists despite periods of significant volatility.

For active traders, volatility creates opportunity rather than deterrent. Daily Bitcoin trading volume across exchanges reaches approximately $17 billion according to data aggregator Newhedge, indicating robust liquidity that allows participants to capitalize on price swings. This trading activity provides depth that makes Bitcoin more viable as serious asset class rather than niche speculation.

Institutional Acceptance Validates Narrative

The debasement trade narrative gains credibility from increasing institutional acceptance of Bitcoin as legitimate portfolio component rather than fringe speculation. When Bitwise’s Matt Hougan—CIO of a major crypto asset manager overseeing billions—publicly predicts the debasement trade will dominate discourse through 2026, it signals that this framing has moved from crypto-native communities into mainstream institutional thinking.

This institutional validation matters because it brings Bitcoin’s debasement thesis to audiences who previously dismissed cryptocurrency as speculation divorced from fundamental value. Corporate treasurers, wealth managers, and institutional allocators respond to narratives framed in familiar investment frameworks—and positioning Bitcoin as inflation hedge similar to gold provides exactly such framing.

The progression from cypherpunk counterculture to mainstream investment thesis represents significant evolution in Bitcoin’s social positioning. Early Bitcoin advocates often identified as libertarian or held anti-establishment political views that mainstream finance found alienating. The debasement trade narrative maintains the core critique of fiat monetary systems while packaging it in language that institutional investors can present to risk committees and clients without political baggage.

Witold Smieszek, Director of Investments for Paramount Digital, notes this continuity between old and new narratives. “It’s pretty much the very foundation of the Bitcoin value story. So in that way it’s nothing new for the old guard who got into crypto through a mix of economics and cypherpunk values,” he observed, recognizing that what institutional investors are discovering as novel investment thesis represents Bitcoin’s original purpose.

Competition From Alternative Cryptocurrencies

While the debasement trade narrative strongly favors Bitcoin, the broader cryptocurrency ecosystem now includes thousands of alternative tokens that compete for investor attention and capital. The prevalence of Layer-1 blockchains, favorable regulatory developments, and corporate interest in various chains creates scenarios where value accrues to tokens other than Bitcoin—potentially fragmenting the debasement trade across multiple assets.

However, Bitcoin maintains unique advantages in the debasement framework that alternatives struggle to match. The fixed 21 million supply cap is both older and more credible than similar caps on newer cryptocurrencies whose governance structures could theoretically change supply schedules. Bitcoin’s lack of identifiable leadership or corporate control makes supply manipulation impossible in ways that don’t apply to cryptocurrencies with foundations, development companies, or identifiable founders who could face pressure to modify monetary policy.

Additionally, Bitcoin’s brand recognition and liquidity depth exceed all competitors by substantial margins. For institutional allocators seeking inflation hedges, the ability to deploy significant capital without excessive slippage matters enormously—and Bitcoin’s trillion-dollar market capitalization provides this capacity where smaller alternatives cannot. The debasement trade at institutional scale requires assets liquid enough to absorb large inflows, favoring Bitcoin over alternatives regardless of their technical characteristics.

Risks and Limitations of Debasement Thesis

While the debasement trade narrative provides compelling framework for Bitcoin investment, several risks and limitations warrant consideration. Most significantly, Bitcoin’s high volatility challenges its characterization as stable store of value—an asset that can lose 20-30% in weeks struggles to fulfill the value preservation function that traditional inflation hedges provide.

Tu acknowledges this limitation explicitly, noting that Bitcoin remains correlated with broader risk assets during extreme stress.

“If the market crashes because the AI bubble pops or something, then we will probably still see the BTC and overall crypto market, and probably gold in the short-term before outperformance in the medium-term, crash as well,”

he observed, recognizing that Bitcoin doesn’t always behave as uncorrelated hedge during crisis periods.

This correlation weakness particularly manifests during liquidity crises where all assets sell off as participants raise cash. The March 2020 crash saw Bitcoin decline alongside equities and even gold temporarily, demonstrating that crisis conditions can override fundamental narratives. For the debasement trade to work as advertised, Bitcoin needs to maintain value precisely when confidence in traditional systems collapses—yet historical evidence shows mixed results during acute stress.

Additionally, the regulatory environment remains uncertain in ways that could undermine Bitcoin’s value proposition. While Bitcoin’s protocol operates independently of government control, governments retain capacity to regulate exchanges, restrict banking system access, or impose ownership restrictions that would substantially impair Bitcoin’s utility. The debasement trade assumes Bitcoin remains accessible and usable—assumptions that depend partly on regulatory tolerance.

The energy consumption critique also poses reputational risk that could limit institutional adoption regardless of investment merits. As environmental considerations increasingly influence investment decisions, Bitcoin’s proof-of-work mining mechanism faces criticism that competing cryptocurrencies using less energy-intensive consensus mechanisms avoid. While defenders argue this energy secures the network that makes Bitcoin valuable as debasement hedge, the debate creates friction in institutional adoption.

Outlook for 2026 Narrative Dominance

Whether the debasement trade becomes 2026’s dominant Bitcoin narrative as Hougan predicts depends on several factors that will unfold over coming quarters. Continued money supply expansion, elevated government debt levels, and persistent inflation would all validate the framework and drive adoption of Bitcoin as hedge. Conversely, successful monetary tightening that restores confidence in fiat currencies without triggering recession could undermine the debasement thesis.

The political environment also influences narrative reception. Policy volatility that reinforces perceptions of government unpredictability supports debasement framing, while policy stability that rebuilds trust in traditional institutions would work against it. The Trump administration’s approach to trade, monetary policy, and regulatory issues will substantially impact whether investors view government-backed assets as reliable or requiring hedging.

Institutional adoption rates provide another indicator. If major endowments, pension funds, or sovereign wealth funds publicly adopt Bitcoin as inflation hedge in their strategic asset allocations, it would validate the debasement narrative and accelerate its mainstream acceptance. Such institutional moves often cluster once early adopters demonstrate success, potentially creating bandwagon effects that rapidly shift consensus.

For now, the debasement trade remains emerging rather than dominant narrative—recognized by crypto-native investors and forward-thinking institutional players but not yet widely accepted across mainstream finance. The transition from niche to dominant narrative typically requires combination of theoretical framework, empirical validation through events, and social proof through respected institutions adopting the thesis. Whether 2026 provides these conditions remains to be seen, but the groundwork for narrative shift appears increasingly established.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.