In Brief

Bitcoin dominance surpasses 60%, marking its strongest market share since 2021 and signaling a broad capital rotation.

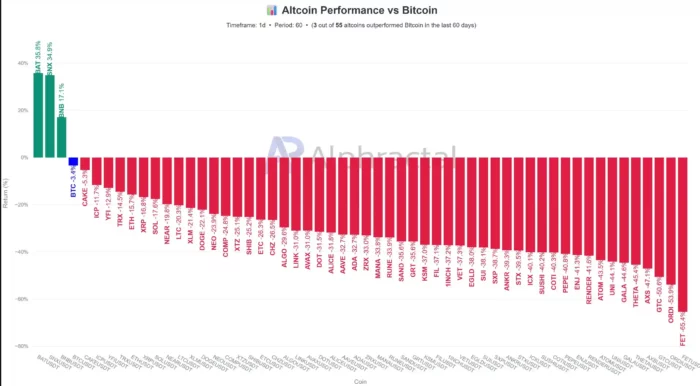

Less than 5% of 55 leading altcoins have outperformed BTC, with losses ranging from 20% to 80% across the sector.

Analysts cite a “risk-off” shift favoring Bitcoin and stablecoins amid macroeconomic uncertainty and reduced market liquidity.

Some traders expect short-term rebounds in RWA, DeFi, and AI-linked tokens if Bitcoin consolidates above key technical levels.

Broader altcoin recovery remains unlikely through 2025, with selective strength limited to projects backed by fundamentals.

Bitcoin dominance is surging again as altcoins falter across the board. The Bitcoin Dominance Index has broken above 60% — its highest reading since mid-2021 — reinforcing Bitcoin’s role as the market’s defensive anchor. Meanwhile, fewer than 5% of top altcoins have managed to outperform BTC, underscoring a deep shift in investor sentiment toward safety and liquidity.

The Main Development: Bitcoin Reclaims Market Leadership

Data from Alphractal shows that only 3 out of 55 major altcoins have outpaced Bitcoin over the past 60 days. The remainder have lost between 20% and 80% of their value, with the Altcoin Season Index falling to around 25–29 — well below the threshold that would signal an altcoin-led market. In other words, crypto has entered another clear-cut “Bitcoin Season.”

On the BTC Dominance (BTC.D) chart, Bitcoin’s share of the total market cap stands at 60.74%, up from 59% in late September — its strongest position in over two years. This pattern reflects a classic capital rotation out of higher-risk assets and back into Bitcoin, often seen during uncertain or consolidating market phases. Analysts such as Benjamin Cowen argue that altcoins could shed another 30% against BTC if Bitcoin’s current uptrend continues into the year’s end.

The shift follows a period of mounting selling pressure. After October’s $19 billion crypto market liquidation, many altcoins broke below structural supports that had formed earlier in the year. If this downward momentum persists, analysts warn that weaker tokens could face a deeper correction heading into Q1 2026.

The Contrast: Traders Split Between Fear and Structural Optimism

Not everyone is bearish. Some traders maintain that Bitcoin’s broader market structure remains intact. BTC continues to hold above its 50-week Exponential Moving Average (EMA) — a key technical level that historically precedes medium-term recoveries. Liquidity metrics have also improved, and optimism is building for a potential U.S. Federal Reserve rate cut in December, which could boost risk appetite across crypto.

Ignore fear, follow structure.

one market participant wrote on X (formerly Twitter), suggesting that Bitcoin’s resilience could ultimately guide a selective recovery across digital assets.

Still, analysts agree that the market is undergoing a defensive repositioning. Institutional inflows and large-cap capital are consolidating into Bitcoin and stablecoins, leaving smaller tokens vulnerable. This type of capital rotation is common in late-cycle phases when traders prioritize liquidity and lower volatility exposure.

Market Impact & Evidence: Data Shows a Deep Risk-Off Shift

The dominance surge highlights the divergence between Bitcoin and the rest of the market. According to TradingView data, BTC.D reached 60.7% in early November — a threshold not seen since 2021’s pre-bull accumulation phase. Historically, such spikes indicate investor caution, as funds flow from speculative altcoins into Bitcoin’s comparatively stable price structure.

Altcoin underperformance also appears in sector-specific breakdowns. Tokens in gaming, metaverse, and meme categories have lost more than 70% since September, while Layer-1 protocols like Solana and Avalanche have dropped around 40%. Meanwhile, Bitcoin has held steady near the $111,000 level, consolidating after hitting an all-time high of $126,000 earlier this month.

Derivatives data further reinforces the trend: open interest in altcoin futures has declined by 18% month-over-month, while Bitcoin futures volume remains elevated. Combined with falling funding rates, the data reflects a broad “deleveraging cycle” — traders reducing exposure to high-beta assets.

Analysis: Why Bitcoin Dominance Matters Now

Bitcoin’s rising dominance is not just a chart milestone — it represents a fundamental reordering of crypto’s internal hierarchy. Each time dominance surpasses 60%, the market effectively signals that it no longer prices growth through speculative narrative, but through structural conviction. Investors are seeking clarity, not risk.

Historically, such periods precede either broad accumulation or multi-quarter consolidations. The current dominance move mirrors 2019’s post-bull cooldown, when BTC absorbed liquidity for nearly eight months before altcoins saw selective rebounds. The macro context — tightening liquidity and rising capital costs — suggests a similar dynamic now.

Analysts also point to behavioral factors. Retail traders remain cautious after consecutive altcoin drawdowns, while institutional desks view BTC as the only scalable crypto hedge. The result is a market bifurcation: Bitcoin as a “reserve asset,” altcoins as speculative instruments awaiting renewed narratives.

Forward Outlook: Selective Recovery Ahead, Not a Full Altseason

While some analysts expect technical relief rallies in the coming weeks, few anticipate a full-fledged altseason through late 2025. A brief recovery could emerge if Bitcoin stabilizes near current levels or experiences a controlled pullback, allowing speculative capital to rotate back into mid-cap assets.

However, this rebound is expected to be narrow and sector-specific. Analysts see opportunities primarily in Real-World Asset (RWA) protocols, DeFi infrastructure projects, and AI-integrated tokens — categories backed by tangible utility rather than narrative hype. In contrast, meme coins, NFT-related tokens, and low-liquidity projects are likely to remain under pressure.

In short, 2025’s crypto market appears set for a selective phase rather than a synchronized boom. Bitcoin’s structural dominance, coupled with macro uncertainty, favors defensive positioning. For traders, that means focusing on quality, liquidity, and disciplined exposure rather than chasing speculative rebounds.

Missed buying crypto at the market bottom?

No worries, there's a chance to win in crypto casinos! Practice for free and win cryptocurrency in recommended casinos! Our website wheretospin.com offers not only the best casino reviews but also the opportunity to win big amounts in exciting games.

Join now and start your journey to financial freedom with WhereToSpin!

Middle East

wheretospininkuwait.com provides a comprehensive selection of trusted online casino reviews for the Middle East أفضل كازينو على الإنترنت. The platform features well-established casinos supporting crypto deposits in the region, including Dream Bet, Haz Casino, Emirbet, YYY Casino, and Casinia.

South Africa and New Zealand

In the South African online casino market, wheretospin.co.za highlights top-rated platforms and online casinos such as True Fortune Casino and DuckyLuck. Meanwhile, for New Zealand players, wheretospin.nz showcases highly recommended casinos, including Casinia, Rooster.bet, and Joo Casino.