In Brief

TRUMP meme coin project announced Trump Billionaires Club mobile game with $1 million token waitlist reward campaign, generating only 3.3% price increase to $5.89—demonstrating that promotional announcements no longer drive sustained momentum for the token that has declined 90% from January all-time highs.

The game integrates 3D board mechanics with Web3 features including NFT collectibles through OpenLoot marketplace, positioning gameplay around virtual empire building and “Billionaire Ladder” progression, yet market participants directly compared TRUMP’s muted response to Bitcoin’s movements, highlighting the disconnect between announcement and actual demand.

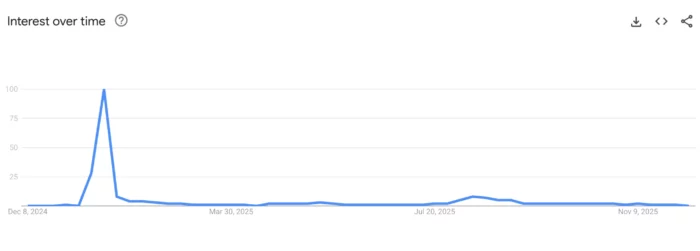

Google Trends data shows search interest for “trump meme coin” has remained flat since the January launch surge, indicating zero retail engagement recovery despite the game promotion—a pattern reflecting broader failure across Trump-linked crypto ventures including MELANIA token, World Liberty Financial (WLFI), and American Bitcoin Corp.

The 3.3% temporary price bump following a $1 million giveaway announcement reveals fundamental demand weakness: promotional incentives that would typically generate 50-100%+ rallies in functioning meme coin markets produce minimal response when underlying attention and speculation have permanently evaporated.

TRUMP’s collapse mirrors systematic pattern across Trump family crypto projects that collectively erased billions in paper wealth, demonstrating that celebrity-branded tokens dependent on sustained attention cannot maintain value when initial hype cycles exhaust and no genuine utility or community emerges to replace speculative interest.

The TRUMP meme coin project announced the launch of Trump Billionaires Club—described as “the first and only Trump mobile game for supporters”—accompanied by a $1 million token giveaway campaign through waitlist participation. The announcement produced a modest 3.3% price increase, bringing the token to $5.89 at time of reporting, a response that market participants characterized as notably weak given the promotional scale. The muted reaction demonstrates that TRUMP has entered a terminal decline phase where even substantial marketing initiatives and financial incentives fail to generate sustained momentum. The token trades 90% below its January all-time highs, reflecting a collapse pattern that has characterized Trump-linked cryptocurrency ventures broadly, including MELANIA meme coin, World Liberty Financial (WLFI) token, and American Bitcoin Corp. mining initiative. Understanding why a $1 million giveaway produces only 3.3% appreciation requires examining the game’s actual features and whether they create genuine utility beyond promotional rhetoric, what Google Trends data reveals about retail attention collapse, why promotional announcements that would typically drive 50-100%+ rallies in functional meme coin markets now generate minimal response, and whether the pattern reflects temporary bear market weakness or permanent attention exhaustion for celebrity-branded tokens lacking organic community or use case.

Trump Billionaires Club: Web3-Integrated Board Game Mechanics

The TRUMP project positioned Trump Billionaires Club as a mobile and web-based 3D board game where players compete to build virtual empires using traditional gameplay mechanics enhanced with optional Web3 features. According to the project’s official website, gameplay centers on earning in-game rewards, unlocking items, and progressing through what developers term the “Billionaire Ladder.”

BIG NEWS! The Official TRUMP MOBILE GAME is COMING SOON! The First and Only Trump Mobile Game for True Trump Fans.

Join the FREE waitlist now for a chance to get a share of $1 MILLION IN $TRUMP COIN REWARDS!

Go to https://t.co/3GPTowXYuR NOW!

The Trump Billionaires Club… pic.twitter.com/2KgMzcUanS

— TrumpMeme (@GetTrumpMemes) December 9, 2025

The Web3 integration operates through OpenLoot, described as “one of the top marketplaces for digital game collectibles.” The game enables collection and trading of limited-edition NFT statues and pins that provide in-game utility. The project’s website states:

The Trump Billionaires Club is powered by Open Loot, one of the top marketplaces for digital game collectibles, to bring real-world trading power to your in-game empire. Collect & Trade limited-edition NFT Statues and Pins that can be used in-game.

The TRUMP token functions as the primary currency for all in-game activity, theoretically creating demand as players engage with gameplay mechanics. However, several structural questions emerge about whether this creates sustainable token utility:

Gameplay Depth and Retention: The description emphasizes “board game” mechanics—a genre characterized by relatively simple, repeatable gameplay loops. Without demonstrating sophisticated game design, compelling progression systems, or competitive multiplayer features that drive sustained engagement, most mobile board games experience brief initial play followed by rapid abandonment. If Trump Billionaires Club follows typical mobile board game retention curves—where 70-90% of players abandon within the first week—any token demand from gameplay proves temporary.

Optional Web3 Features: The positioning of Web3 integration as “optional” suggests the core game functions without blockchain elements. This design choice makes economic sense for player acquisition (avoiding crypto onboarding friction) but undermines token demand. If players can enjoy full gameplay without touching TRUMP tokens or NFTs, the blockchain layer becomes peripheral rather than central to user experience.

NFT Utility Scope: The game offers NFT collectibles with in-game utility, but utility scope determines whether this creates meaningful demand. If NFTs provide minor cosmetic benefits or marginal gameplay advantages, most players will ignore them. If NFTs provide substantial power advantages, the game risks becoming pay-to-win, alienating non-spending players and creating negative community sentiment that accelerates abandonment.

Existing OpenLoot Integration Precedent: OpenLoot has integrated with various games previously. Examining those integrations’ success rates provides context. If most OpenLoot-integrated games failed to maintain player bases or trading volume for their digital collectibles, it suggests the infrastructure exists but doesn’t guarantee engagement.

The fundamental challenge: creating a mobile game that people actually want to play repeatedly for intrinsic enjoyment requires substantial game design expertise and iterative development. Bolting Web3 features onto mediocre gameplay doesn’t transform the product into a compelling experience. The announcement provides marketing language about empires and billionaire ladders but offers no evidence of actual gameplay depth, retention mechanics, or competitive features that would distinguish Trump Billionaires Club from the hundreds of failed crypto-gaming attempts.

Market Response Reveals Fundamental Demand Weakness

The 3.3% price increase following the game announcement and $1 million giveaway campaign reveals critical information about TRUMP’s market structure and remaining demand.

In functional meme coin markets, major announcements—particularly those including substantial monetary incentives—typically generate 50-100%+ price rallies as speculation about increased adoption and utility drives buying. The fact that a $1 million giveaway produces only 3.3% appreciation indicates that:

Speculative Capital Has Permanently Exited: The traders and speculators who drove TRUMP’s initial price discovery in January have moved to other opportunities. They’re not monitoring TRUMP for potential catalysts. The announcement didn’t reach them, or it reached them and they consciously declined to re-enter despite the incentive.

Remaining Holders Lack Conviction: The modest 3.3% bump suggests even existing holders didn’t significantly increase positions despite theoretically bullish news. If current holders believed the game would drive sustained demand, they would accumulate aggressively at current prices representing 90% discounts from peak. The absence of this behavior indicates holders are either: (a) already fully allocated and unable to add exposure, or (b) skeptical that the game will materially change trajectory.

Arbitrage Considerations Dominate: Some portion of the 3.3% move likely represents traders calculating expected value from the $1 million giveaway divided by effort required to participate. If signup takes minimal time and tokens can be immediately sold, it creates a small arbitrage opportunity. But the muted response suggests even this incentive proves insufficient to attract meaningful participation.

One market participant directly compared TRUMP’s price action to Bitcoin’s movements, highlighting the disconnect. When meme coins lose independent momentum and merely track broader market movements, it signals that token-specific narratives no longer drive price discovery. TRUMP is behaving as a zombie asset—technically still trading but lacking organic buying interest independent of general market direction.

Google Trends Data Confirms Retail Attention Collapse

Google Trends data for the search term “trump meme coin” demonstrates that retail attention has remained completely flat since the January launch surge. The initial spike when the token launched—driven by novelty, Trump’s prominence, and speculative mania—has never recovered despite subsequent promotional efforts.

This flat search interest pattern proves economically significant because it demonstrates that the game announcement didn’t penetrate mainstream retail awareness. If Trump Billionaires Club launch represented a meaningful catalyst, Google search volume would spike as curious potential players and speculators researched the token. The complete absence of this spike indicates:

Marketing Reach Failure: Either the announcement didn’t reach audiences beyond existing token holders, or it reached broader audiences who consciously chose not to investigate further. Both interpretations suggest the promotional strategy failed to generate interest beyond the already-captured base.

Trump Brand Fatigue: The flat search pattern suggests Trump-branded crypto projects have exhausted novelty value. The initial January surge captured everyone interested in Trump-themed speculation. Subsequent projects and announcements reach a saturated audience that has either already participated and exited or consciously declined initial participation.

Meme Coin Lifecycle Completion: Successful meme coins experience multiple attention waves as different audience segments discover the token at different times. Flat search interest indicates TRUMP completed its entire lifecycle in the initial January spike—early adopters bought, peak attention occurred, late entrants provided exit liquidity, and the cycle concluded. No second wave of attention has emerged or appears likely.

The search data validates that TRUMP faces a fundamental attention problem rather than temporary bear market weakness. Temporary weakness would show search interest fluctuating with broader market sentiment—spiking during crypto bull runs, declining during corrections. Completely flat interest regardless of market conditions indicates permanent attention exhaustion.

Systematic Trump Crypto Venture Collapse Pattern

TRUMP’s struggles occur within a broader pattern of collapse across Trump family cryptocurrency ventures. As previously reported, multiple Trump-linked projects have experienced steep value declines:

MELANIA Meme Coin: Launched shortly after TRUMP, MELANIA followed an identical trajectory—brief initial surge followed by sustained decline as attention evaporated. The token currently trades at a fraction of launch prices with minimal daily volume.

World Liberty Financial (WLFI): Trump’s more “serious” cryptocurrency venture positioned as a DeFi platform has seen its token decline substantially from early valuations. The project promised institutional-grade financial services but has failed to demonstrate meaningful adoption or differentiation from existing DeFi protocols.

American Bitcoin Corp.: The Trump family’s mining venture initially valued Eric Trump’s stake at approximately $630 million. Shares subsequently declined more than 50%, erasing roughly $300 million in paper wealth. The collapse reflects both broader Bitcoin mining sector weakness and questions about the venture’s competitive positioning.

The systematic failure across Trump crypto projects reveals a consistent pattern: initial launch hype driven by Trump brand recognition and political supporter enthusiasm, followed by rapid decline as participants realize that celebrity association doesn’t create sustainable value without genuine utility, community, or differentiation.

This pattern reflects a fundamental dynamic in celebrity-branded tokens: they function as attention-capturing devices that monetize brand recognition but lack the organic community formation, utility development, or cultural momentum that enables successful meme coins like DOGE or SHIB to maintain relevance across multiple market cycles.

Why Promotional Announcements No Longer Generate Momentum

The failure of a $1 million giveaway to produce meaningful price response illustrates a critical dynamic in meme coin lifecycle: once attention permanently shifts away from a token, no amount of promotional spending can force its return.

Announcement Fatigue: Every meme coin project facing declining interest eventually resorts to announcement-driven promotional campaigns—partnerships, celebrity endorsements, feature releases, giveaways. When the first few announcements fail to generate sustained momentum, each subsequent announcement faces higher skepticism. Market participants pattern-match to recognize desperation marketing rather than genuine development progress.

Trust Erosion: The 90% decline from peak has destroyed trust among anyone who bought TRUMP at higher prices. These burned participants view new announcements with suspicion rather than enthusiasm. They assume announcements are designed to create temporary pumps enabling earlier buyers to exit rather than genuine developments that will restore value.

Competitive Attention Economy: The meme coin sector operates in a brutally competitive attention economy where new projects and narratives emerge constantly. Even if TRUMP generates slight temporary interest, dozens of newer meme coins with fresh narratives and earlier-stage appreciation potential compete for the same speculative capital. Why would a trader allocate to TRUMP hoping for recovery when they could allocate to new meme coins at ground floor?

Narrative Collapse: TRUMP’s narrative—”the Trump meme coin”—has been fully explored and exhausted. The token said everything it had to say during January launch. A mobile board game doesn’t create a new narrative; it’s a feature added to an exhausted story. Successful meme coin narratives evolve through community-driven creativity and cultural moments. Corporate-announced features don’t create narrative evolution; they reveal narrative bankruptcy.

Forward Outlook: Terminal Decline Versus Remote Recovery Possibility

TRUMP faces a binary outcome: either the token remains in terminal decline with no realistic recovery path, or some unprecedented catalyst generates genuine renewed interest that reverses trajectory.

Terminal Decline Scenario (Most Probable): TRUMP continues slow erosion toward price levels reflecting only the most stubborn holders and automated trading bots. Trading volume declines toward zero as market makers withdraw liquidity. The game launches but attracts minimal players who quickly abandon. The token becomes a cautionary tale about celebrity crypto ventures rather than a success story. Trump family promotional efforts shift to newer projects rather than attempting TRUMP revival.

Remote Recovery Scenario (Highly Improbable): The game achieves unexpected viral success through gameplay quality, creating organic player demand for tokens. Trump’s political profile generates renewed mainstream attention that spills over to the token. A major exchange listing or institutional endorsement creates legitimacy and buying pressure. These scenarios require multiple low-probability events occurring simultaneously and sustained rather than temporary interest.

The evidence overwhelmingly supports the terminal decline scenario. The game announcement—accompanied by $1 million incentive—should have represented an optimal catalyst for renewed interest. The 3.3% response demonstrates that even optimal conditions produce minimal results. Without evidence of changing dynamics, continuation of established patterns (ongoing decline, flat attention, minimal volume) represents the rational expectation.

Structural Lessons: Celebrity Tokens Without Organic Communities

TRUMP’s trajectory offers clear lessons about celebrity-branded cryptocurrency tokens:

Launch Hype Doesn’t Equal Sustainability: Celebrity tokens can achieve spectacular initial price discovery as novelty and brand recognition attract speculation. However, this initial success doesn’t predict sustained value. Most celebrity tokens complete their entire lifecycle within weeks or months of launch.

Announcement-Driven Marketing Fails: Once organic attention evaporates, promotional announcements and giveaways cannot force its return. Markets quickly distinguish between genuine development progress and desperation marketing designed to create temporary pumps.

Competitive Dynamics Favor New Narratives: The constant emergence of new meme coins with fresh narratives means that attention-dependent tokens face relentless competitive pressure. Older tokens with exhausted narratives cannot compete against newer projects offering early-stage appreciation potential.

Utility Addition Cannot Replace Community: Adding features like games or NFT integrations doesn’t create the organic community enthusiasm that sustains successful meme coins. Community forms around shared culture, humor, and identity—not around corporate-announced features.

The TRUMP case study demonstrates that celebrity association provides powerful launch advantage but doesn’t create the fundamental ingredients—organic community, evolving narrative, cultural relevance—required for meme coin longevity. Without these ingredients, promotional efforts produce diminishing returns until they generate no response at all.